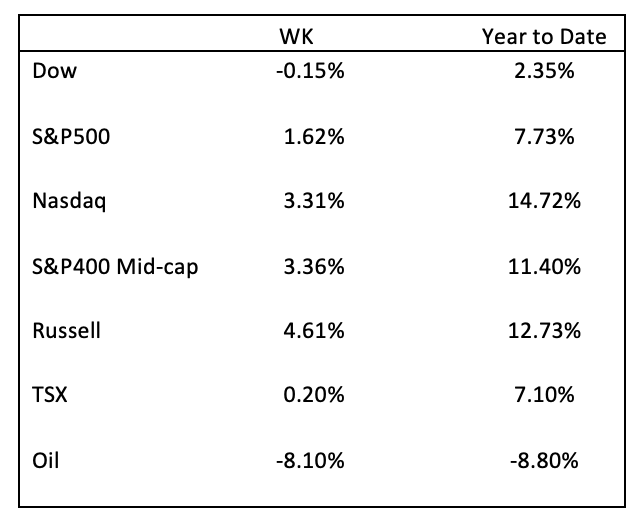

Most equity markets continued their January rally supported by Q4 earnings reports, surprising economic data, and what was interpreted as dovish comments from Fed Chairman Jerome Powell in his news conference following the FOMC meetings and the announcement of a 25-basis-point Fed funds rate increase. The Nasdaq, mid and small cap indices pushed higher, posting the strongest gains of all indices. The TSX struggle to stay positive in the week under the weight of oil falling just over 8%. Most European equities markets posted robust gains in hopes that the restrictive monetary policy cycle may end soon.

The wave of Q4 earnings announcements during the week startled investors. Meta’s earnings report moved the stock 27% in one day, the largest single-day move in almost ten years. On the other hand, Amazon, Apple and Alphabet reported disappointing results. According to FactSet, half the S&P 500 companies have reported Q4 earnings. Of those reporting companies, 70% have reported earnings surprises, with 61% reporting positive surprises. Blended earnings (actually reported and anticipated) for Q4 declined by a negative 5.3% and, if that holds, will result in a year-over-year decline in earnings. For Q1 2023, guidance from 37 of the S&P 500 companies was negative, with six companies of the S&P 500 issuing upbeat guidance. The forward P/E ratio for the S&P 500 is 18.4 versus 18.5 for the five-year average and 17.2 for the ten-year average.1

On Tuesday, the Employment Cost Index, as the US Bureau of Labor Statistics reported for the three months ending December, rose 1%, with benefit costs rising 0.8. Wages increased by 5.1% for the 12 months compared to 4% in 2021. The US Fed closely watches wage and benefit growth in its fight against inflation.2 It is one of the vital data points contributing to the continuation of the restrictive policy. Also on Tuesday, the US non-profit Conference Board reported that the consumer confidence index fell to 107.1 from 109 in December. A measure of how consumers felt about the current economy jumped to 150.9 from 147.4 in December, but the outlook for six months dropped to 77.8 from 83.4. Historically, a reading below 80 often indicates a recession in the next 12 months.3

On Wednesday, the ADP payroll report disappointed with private employers adding only 106,000 jobs in January. The survey was skewed because, during the reference week used, there were floods in California and ice storms in the central and eastern US.4 Another indication of a weak economy, the Institute for Supply and Manufacturing reported its January manufacturing survey at 47.4%, a drop of one percentage point from December. The New Orders Index fell 2.6 percentage points to 42.5%, remaining in contraction territory, and the Prices Index rose 5.1 percentage points to 44.5%. On a positive note, the Back Order Index rose two percentage points to 43.4%.5 (Readings below 50 signals contraction).

In a sign that the labor market remains tight, the US Department of Labor reported Wednesday that job openings on the last business day of December increased to a five-month high of 11 million. Hires, separations and quits changed little over the previous period. Employers with 50 to 249 employees enjoyed the most openings, whereas larger employers with over 5,000 lost openings in the month.6

On Wednesday, the Federal Reserve increased its policy rate by 25 basis points, and in the following news conference, Chair Powell shed light on future increases. “We continue to anticipate that ongoing increases will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time,” he stated. Further, later in the news conference, he said, “if the market performs broadly in line with those expectations, it will not be appropriate to cut rates this year, to loosen policy this year.” Those expectations refer to “a forecast of slower growth, some softening in labor market conditions, and inflation moving down steadily but not quickly.”7

During the news conference, the Fed Chairman mentioned “disinflation” concerning several data points. We believe the market took this as dovish comments, reversing the earlier market sell-off and sending the market higher in the day. This triggered a spate of short covering, exacerbating the move higher.

On Thursday, the initial unemployment claims for the week ending January 28 continued the trend lower with a decrease of 3,000 to 186,000. Claims for all benefit programs for the period ending January 14 also fell to 1,890,277, a decrease of 45,459.8 The week’s most prominent, surprising data point came on Friday with the nonfarm payrolls. The number of new jobs created in January jumped by 517,000 compared to estimates below 200,000. Gains were led by leisure and hospitality and professional and business services.9 The latest new jobs reading is the largest gain in 6 months and indicates persistent job strength despite contrary indications of a weakening economy.

We believe the robust gains of the first five weeks of the year could spark complacency that may be misplaced in the coming weeks as the reality of the global environment comes into play. As a result, we expect more volatility in the coming months as the market continually reassesses.

Sources:

2 https://www.bls.gov/news.release/eci.nr0.htm

3 https://www.conference-board.org/topics/consumer-confidence

4 https://adpemploymentreport.com/

6 https://www.bls.gov/news.release/pdf/jolts.pdf

7 https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20230201.pdf

8 https://www.dol.gov/ui/data.pdf

9 https://www.bls.gov/news.release/empsit.nr0.htm

Important Information:

Warren Gerow is an independent investment wealth consultant to Sightline Wealth Management.

Sightline Wealth Management LP (“Sightline”) is an investment dealer and is a member of the Investment Industry Regulatory Organization of Canada (IIROC) and the Canadian Investor Protection Fund (CIPF). Sightline provides management and investment advisory services to high-net-worth individuals and institutional investors.

Sightline Wealth Management LP is a wholly owned subsidiary of Ninepoint Financial Group Inc. (“NFG Inc.”). NFG Inc. is also the parent company of Ninepoint Partners LP, it is an investment fund manager and advisor and exempt market dealer. By virtue of the same parent company, Sightline is affiliated with Ninepoint Partners LP. Information and/or materials contained herein is for information purposes only and does not constitute an offer to sell or solicitation to purchase securities of any issuer or any portfolio managed by Sightline Wealth Management or Ninepoint Partners, including Ninepoint managed funds.

The opinions and information contained in this article are those of Sightline Wealth Management (“Sightline”) as of the date of this article and are subject to change without notice. Sightline endeavors to ensure that the content has been compiled from sources that we believe to be reliable. The information is not meant to be used as the primary basis of investment decisions and should not be constructed as advice. Each investor should obtain independent advice before making any investment decisions.