If you’ve spoken to an investor who retired immediately before the Great Financial Crisis of 2008, the first thing they might tell you is that the retirement lifestyle they had banked on through decades of saving and investing disappeared almost overnight. Portfolio losses hurt when you are contributing funds in the accumulation phase, but they are downright deadly when you’re in the withdrawal phase.

Sequence of Return Risk

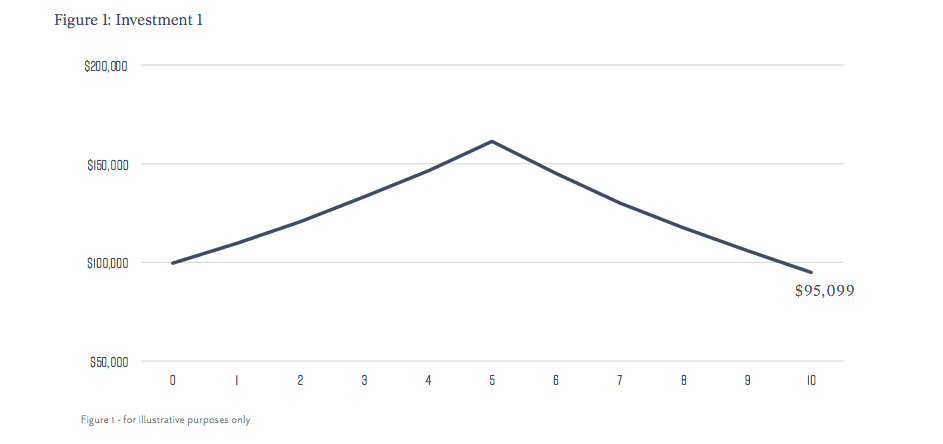

If you started with a $100,000 portfolio and made no new contributions or withdrawals, the sequence of returns of that portfolio are irrelevant to your ending value. For example, let’s say you experience five consecutive years of +10% annual returns followed by five consecutive years of -10% returns. You would end up with $95,099 (figure 1).

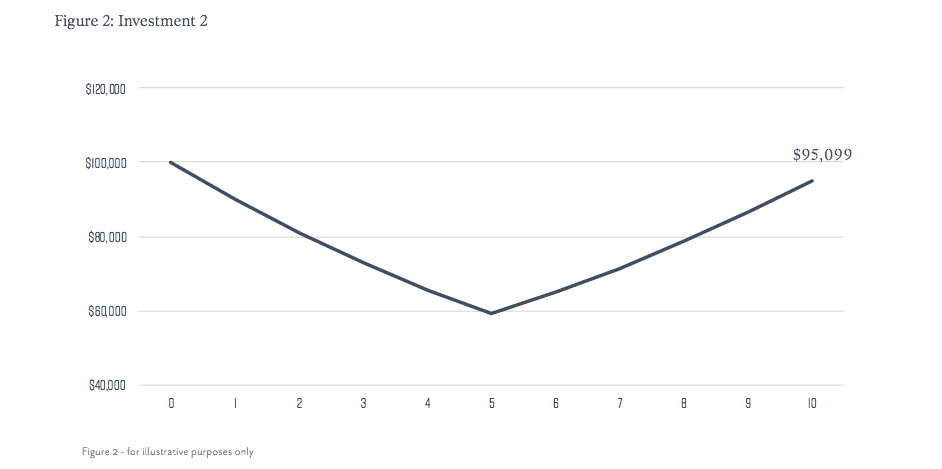

If the order of those returns were exactly reversed, with five consecutive years of -10% returns followed by five consecutive years of positive 10% returns, you would have the exact same $95,099 outcome (figure 2).

But if you add cash flows, either through contributions into the portfolio or withdrawals out of the portfolio, the sequence of returns can have a big impact on the ability of your portfolio to fund your goals.

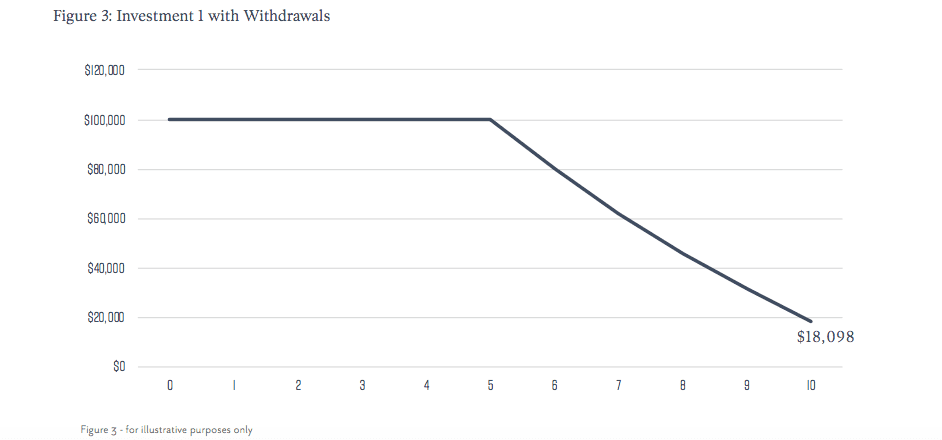

Using the same two return scenarios, let’s now withdraw $10,000 annually at the end of each year. In the scenario where the strong returns occur first, we end up with $18,098 after 10 years, even after taking out $10,000 every year (figure 3).

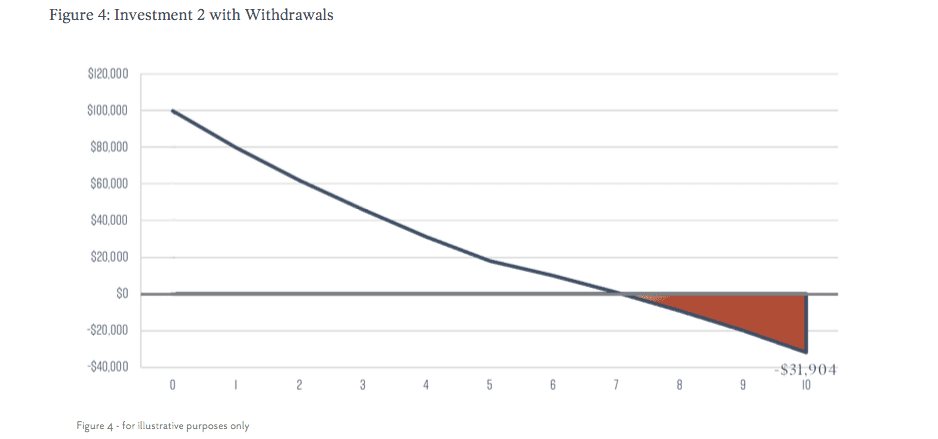

But in the second scenario where the returns were initially weak, we would run out of money just after the end of year seven (see figure 4, below). Extrapolate this example out for a retirement scenario and the sequence of returns could be the difference between a comfortable retirement with a residual legacy, versus running out of money. The different timing of drawdowns and subsequent compounding accounts for the different outcomes of the two paths. The timing of drawdowns matter, and they matter a lot.

How Often Do Drawdowns Occur?

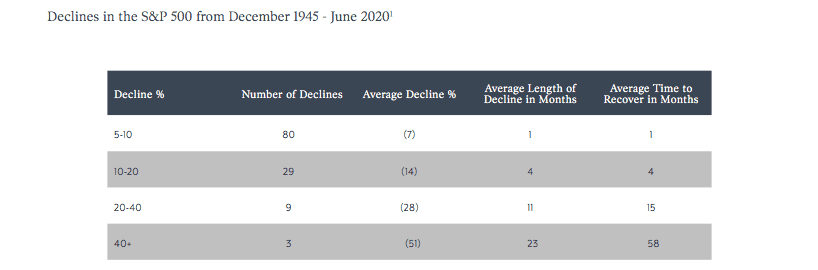

In the 75-year period starting from December 1945, the S&P 500 experienced 80 pullbacks (defined as a decline between -5% and -9.9%), 29 corrections (-10% to -19.9%), and 12 bear markets (more than a 20% decline)1 – an average of 1.6 drawdowns per year. During this timeframe, there were three declines averaging -51%, the most recent of those being in 2008.

Of course, relatively few long-term investors have 100% equity exposure when they are approaching retirement or are already retired. One of the more basic portfolio management rules of thumb for investors has been to increase their bond exposure as they get older. This would have worked quite well for the majority of the last 70 years, especially given the tailwind of falling interest rates which have generated handsome returns, even from what would be considered the safer fixed income side of the portfolio. Bond prices, you will recall, go up when interest rates go down.

But in a low interest rate environment, with little end in sight, the prospects of the traditional balanced portfolio need to be re-examined.

This is a great example that helps explain what some of the differences of alternative asset classes can be. Like a house, an alternative investment may not have the same level of liquidity as with a publicly traded stock. But few real estate owners would complain about the long-term value of that particular asset class. Alternative investments can also include strategies such as investing in private equity (companies whose shares do not trade on public exchanges), or private credit (loans made by private investors to companies unable to access bank financing for a variety of reasons), among others.

In addition to the potential for alternative asset classes to dampen the effect of drawdowns, several alternative asset classes, such as private credit, offer investors reliable income streams, helping to offset fixed income’s inability to do so in a chronically low interest rate environment.

Adding Alternative Asset Class Exposure to Reduce the Risk of Running Out of Money

A portfolio should not be 100% invested in alternative investments, and indeed, few are. But the idea of adding alternative investments as an asset class to complement the more traditional asset classes is actually a time-tested one. In the world of large pension plans and sovereign wealth funds, alternative asset classes have been used for decades, to great success.

Today, professionally managed alternative investments and strategies are available to all retail investors. The benefit? More effective diversification that can help protect today’s portfolios against the effect of common market drawdowns, helping you better manage your risk of running out of money.

Why The Old Playbook May Not Work

The long-term path of interest rates is almost guaranteed to be quite different than what previous generations of investors have experienced, and that can be difficult for people to accept. Following the 2008 financial crisis, it appeared that interest rates were not meaningfully going back up – ever. And now, 12 years on from the financial crisis with the addition of the COVID-19 pandemic, interest rates have effectively returned to zero, and governments are providing emergency financial support to both individuals and businesses at the cost of super-sizing sovereign debt. While analysts are discussing the possibility of 10 years of low rates, our view at Sightline is that we expect rates to be in this range throughout our lifetime.

This does not bode well for traditional fixed income investments. Retirees have already been adding risk to their portfolios for years, adding dividend-paying equities, for instance, to compensate for the lower yield of their fixed income holdings. As noted, this opens their nest eggs in a frightening way to the risk of future drawdowns. What is an investor to do?

Diversification in a Low Yield World

There is an acronym to describe the view of countless market pundits who only see the investment world through the lens of traditional equities and fixed income, TINA: “There Is No Alternative.” And that just doesn’t make sense. Investors have long accepted the idea that negatively correlating asset classes are good for portfolios – that’s always been the logic behind the traditional 60% stock/40% bond portfolio. Today, the question is what investments will play the role of the negatively correlated asset classes now that bonds have all but capitulated from that role. Enter the world of alternative investments.

There’s a wide range of assets and strategies that fit into the alternative asset class, because alternative just means something other than owning stocks and bonds. Many people are already heavily invested in alternative asset classes because they own their own house. Real estate has attractive long-term rates of return and, importantly, the way real estate goes up and down is not heavily correlated with what happens in stocks and bonds.

Click here to download the PDF.

Sources:

1. https://www.aaii.com/journal/article/stock-market-retreats-and-recoveries; https://www.guggenheiminvestments.com

Important Information:

Sightline Wealth Management LP (“Sightline”) is an investment dealer and is a member of the Investment Industry Regulatory Organization of Canada (IIROC) and the Canadian Investor Protection Fund (CIPF). Sightline provides management and investment advisory services to high-net-worth individuals and institu- tional investors primarily through fee-based accounts. Sightline Wealth Management LP is a wholly owned subsidiary of Ninepoint Financial Group Inc. (“NFG Inc.”). NFG Inc. is also the parent company of Ninepoint Partners LP, it is an investment fund manager and advisor and exempt market dealer. By virtue of the same parent company, Sightline is affiliated with Ninepoint Partners LP. Information and/or materials contained herein is for information purposes only and does not constitute an offer to sell or solicitation to purchase securities of any issuer or any portfolio managed by Sightline Wealth Management or Ninepoint Partners, including Ninepoint managed funds.

The opinions and information contained in this article are those of Sightline Wealth Management (“Sightline”) as of the date of this article and are subject to change without notice. Sightline endeavors to ensure that the content has been compiled from sources that we believe to be reliable. The information is not meant to be used as the primary basis of investment decisions and should not be constructed as advice. Each investor should obtain independent advice before making any investment decisions.