Institutional Investment Strategies for Retail Investors

But what are the trade-offs?

What Is a Liquid Alternative?

In early 2019, Canadian regulators amended certain investment restrictions on Canadian mutual funds allowing investment managers to invest in specific alternative strategies and to create a new Alternative Mutual Fund structure, commonly known as “Liquid Alts.” The Liquid Alternative structure is a big step towards democratizing access to alternative investments. Strategies that have historically been limited to institutional and high-net-worth investors are now available to all Canadians, albeit in a modified form.

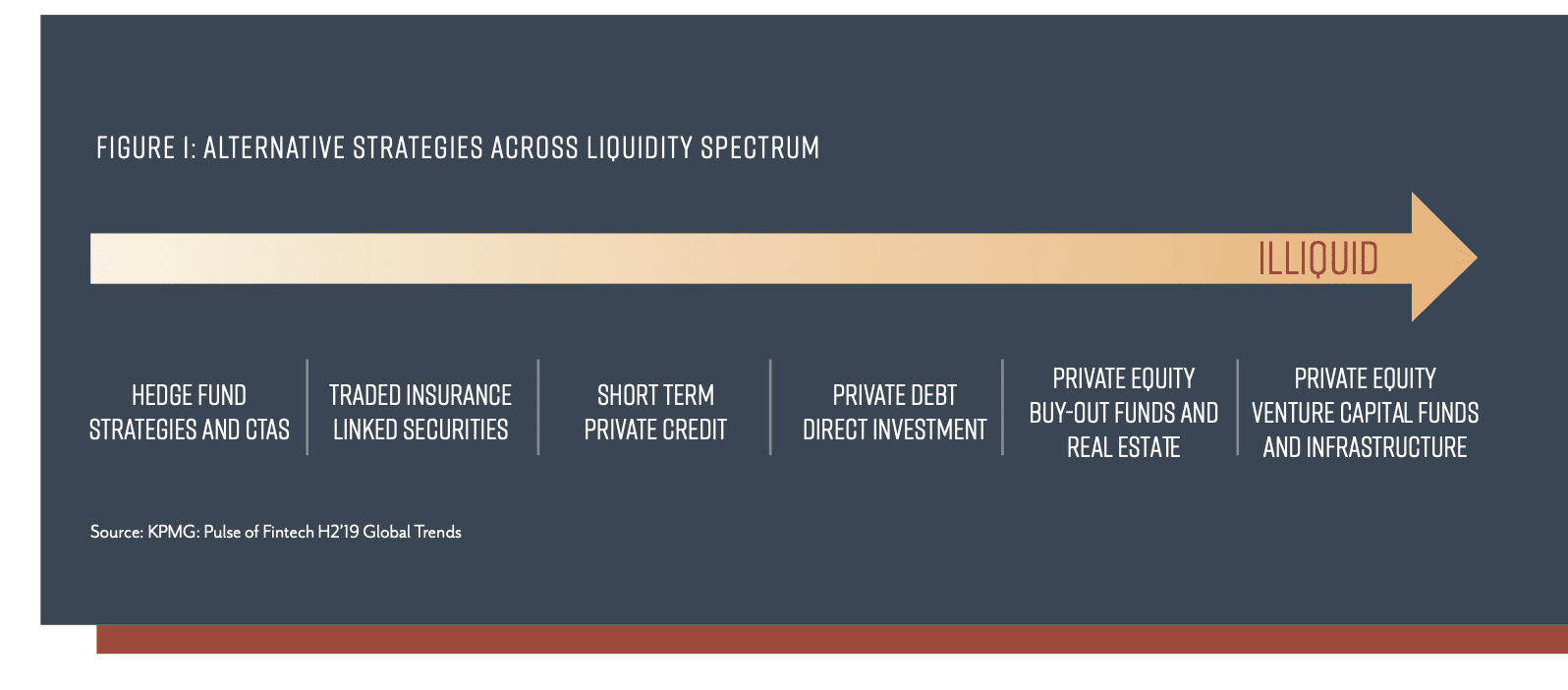

Alternative strategies vary greatly in liquidity and some strategies are a better fit for the Liquid Alt structure than others. Liquidity is defined as the speed and relative cost at which an investment can be converted to cash. Liquid Alternatives, as the name suggests, have a strict liquidity threshold to adhere to in order to qualify, offering daily redemptions in many cases. As discussed in a previous article, “An Argument for Tiered Liquidity,” investment liquidity has many benefits, however, it does come at a cost and some strategies do not translate well to a liquid fund structure.

Alternative investments are typically described as being any asset class that is not common equity, bonds, and cash. This loose definition allows for a vast universe of potential investment options to fall under the “alternative” umbrella. A true alternative should provide a reduction in correlation to traditional public equities and bonds. As we will discuss later, not all Liquid Alts offer the true benefits of alternative investing.

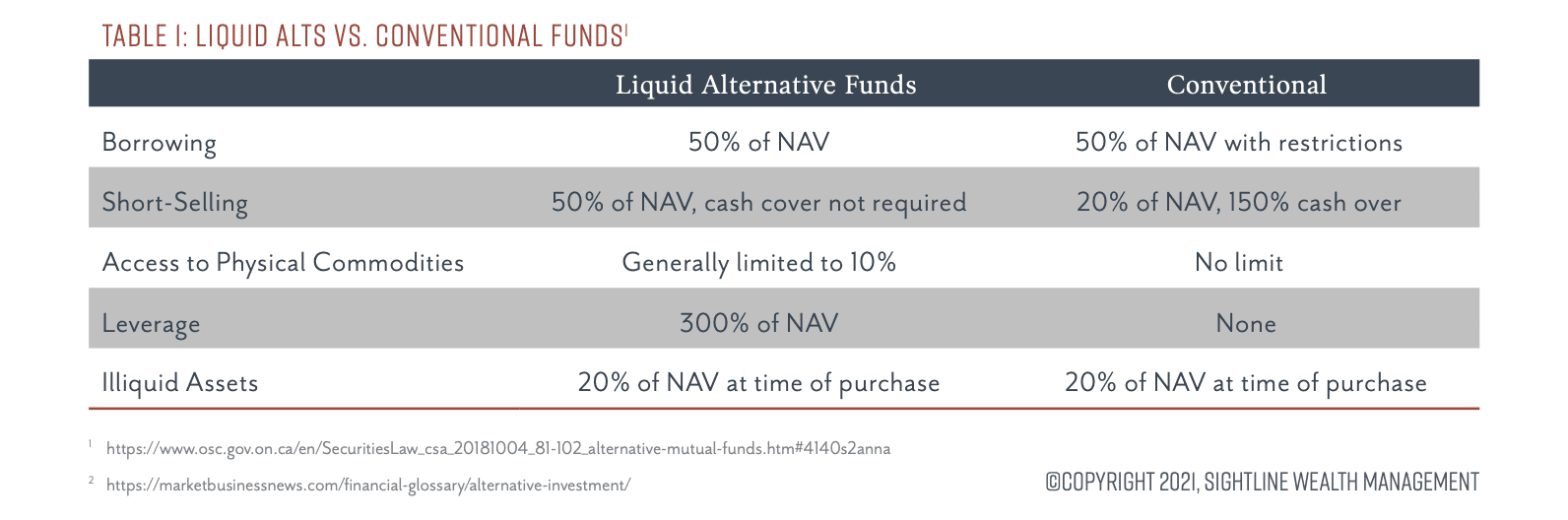

In order to operate as a Liquid Alt, a fund must meet restrictions on leverage, liquidity and borrowing, amongst others (see Table 1). These limitations were designed to protect investors from the potential losses associated with hedge fund mismanagement. Unfortunately, in addition to limiting downside risk, these restrictions have impacted how some strategies achieve their return. It is important for investors to understand how the original alternative investment worked and then evaluate whether or not the Liquid Alternative version is an appropriate proxy for their return profile.

Liquid Alternative Investment Strategies

Some alternative investment strategies are a better fit for the Liquid Alt structure than others. Hedge fund strategies, futures trading funds run by Commodity Trading Advisors (“CTAs”), and some Insurance-Linked Securities (“ILS”) strategies are a good fit due to their inherent liquidity. Investments such as private debt, private equity, infrastructure and direct real estate are not typically good candidates for Liquid Alternatives. These strategies involve investing capital where there is little to no secondary market, and therefore it is difficult for these strategies to adhere to the strict liquidity definition of a Liquid Alt.

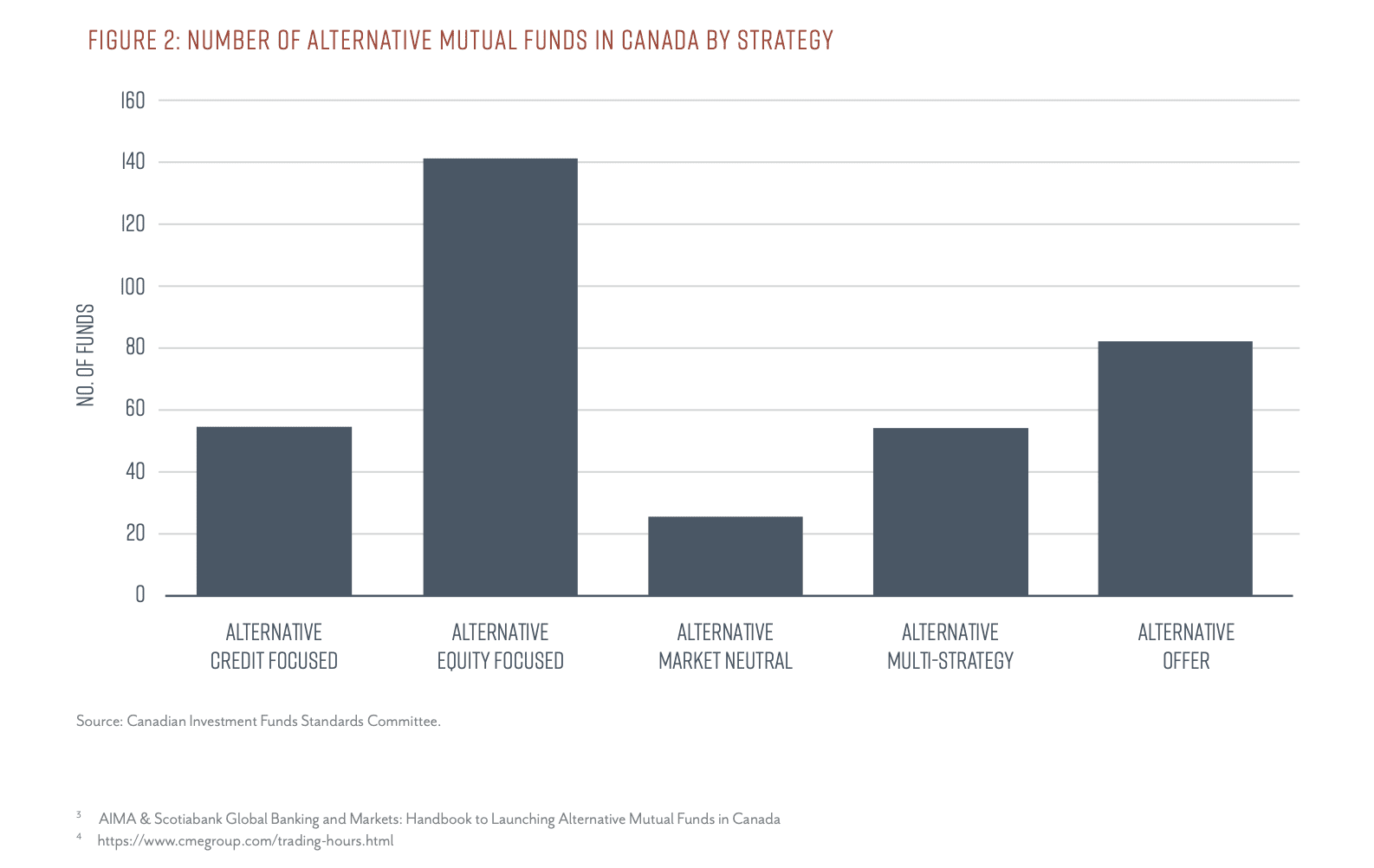

The most frequently employed strategies for Liquid Alts today are variations of typical hedge fund strategies (see Figure 2). These include long/short, market neutral, global macro, or some combination of these in a multi-strategy fund. Each of these include short-selling securities to reduce market correlation, as well as the use of leverage to enhance returns. For example, a market neutral strategy endeavors to purchase securities expected to grow in value, while short-selling securities expected to decrease in value, all while maintaining a market beta of 0.

Managed future strategies are another popular Liquid Alternative because of the inherent liquidity in the exchange traded futures market. Futures contracts traded on a futures exchange allow the sellers (or buyers) of the underlying commodities certainty on the price they will receive (or pay) at the market. Many contracts are traded globally six days per week on the Chicago Mercantile Exchange, giving traders more opportunity to buy and sell contracts than even the most liquid equities. Futures are also traded on margin, which has historically allowed hedge funds to employ large amounts of leverage to enhance returns.

Canadian Liquid Alts in the Insurance-Linked Securities space are more rare, although recent market volatility has made catastrophe bonds (“cat bonds”) a more attractive asset. Liquid Alt products in the United States and Europe have been investing in the space for some time. Cat bonds are similar to plain vanilla bonds issued by insurance companies except that the principal repayment is linked to a specified event. The cat bond pays the investor a fixed or floating coupon until expiry when the principal is repaid. However, if a prespecified event, “the catastrophe,” occurs, then all or a portion of the principal is forfeited and used to pay claims associated with that event.

For example, an insurance company sells hurricane insurance in Florida, and then sells cat bonds that are triggered in the event of a Category 3 hurricane making land fall in Tampa Bay.

Investors are compensated for the credit risk associated with the insurance company as well as the risk of loss associated with the catastrophic event. These two premiums result in enhanced return with downside risks (of a catastrophic event) being uncorrelated to the broader markets.

While innovative managers are sure to introduce many more categories of Liquid Alts in the next several years, we will continue our discussion by reviewing the currently available Liquid Alt strategies which are primarily based on traditional, more liquid hedge fund strategies.

Why Invest in Liquid Alternatives?

Diversification

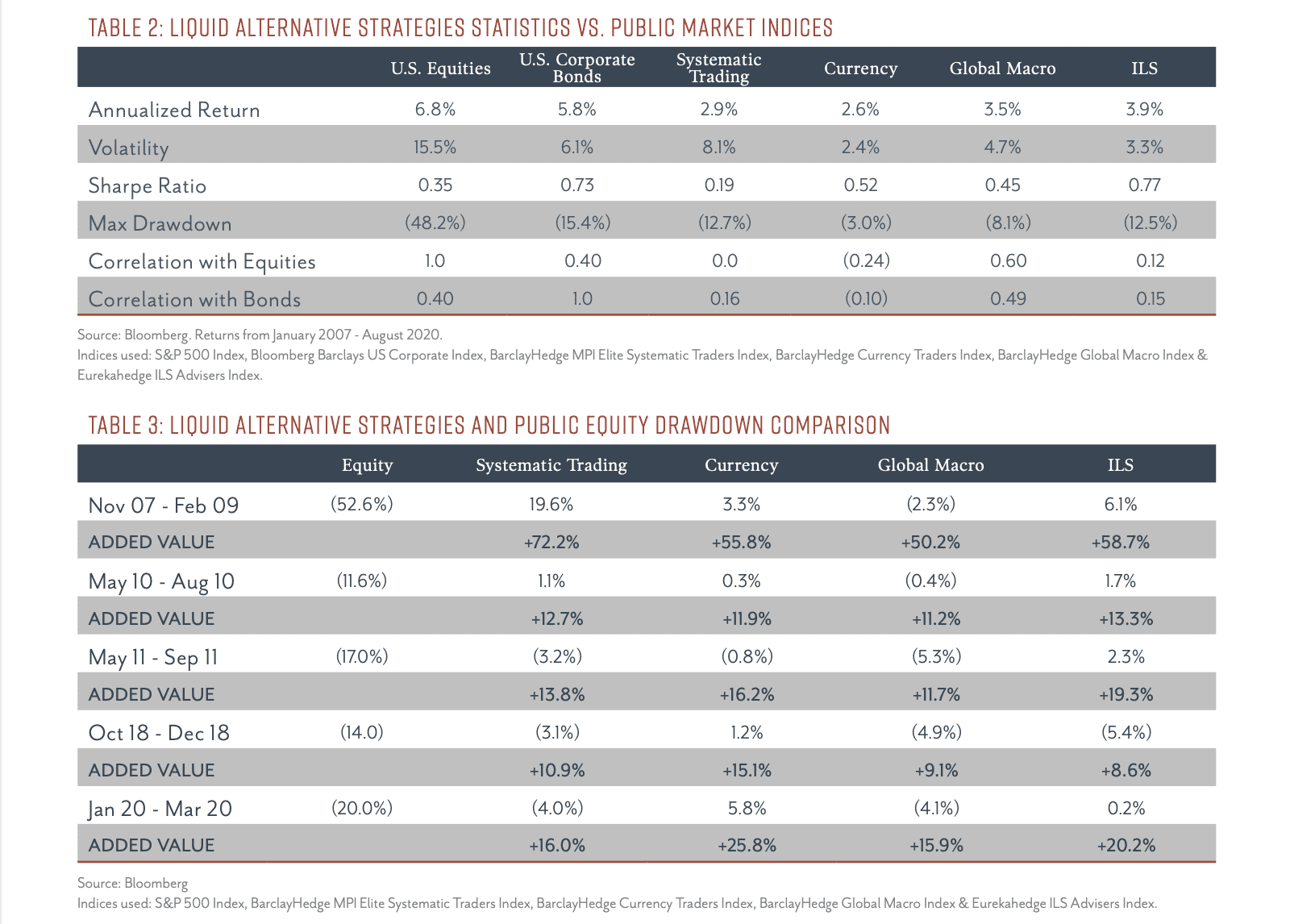

Liquid alternatives can be a powerful investment in any portfolio. These strategies aim to have low correlations to equity and fixed income indices and can be used as a long-term diversification tool. Like traditional alternative investments, liquid alternatives aim to provide downside protection and/or absolute returns in any market environment. Table 2 highlights the performance statistics of U.S. Equities and Bonds, as well as typical hedge fund strategies including CTA strategies (Systematic, Currency and Global Macro) and ILS. Despite achieving lower annualized returns, in most cases, these strategies generate stronger risk-adjusted returns on a standalone basis, as indicated by their average Sharpe Ratios.

The primary reason being that these strategies typically exhibit lower volatility compared to investments in the public market and thus can provide investors with further diversification to their portfolio. As these investments have low historical correlations to public investments, they can provide significant downside protection and reduce portfolio drawdown during market corrections. On average, these strategies outperformed the S&P 500 by 23.4% during market corrections (see Table 3). An allocation to Liquid Alts in a portfolio is expected to increase risk-adjusted returns and reduce max drawdown while maintaining liquidity.

Liquidity

Liquid Alts provide investors with access to alternative strategies that in most cases will have daily liquidity. One of the considerations that high net-worth investors battle with when allocating to traditional alternatives is the lack of liquidity. Bridging the gap between hedge funds and mutual funds, these Liquid Alternative strategies will allow investors to reap some of the benefits from traditional alternatives without the liquidity concerns. However, it is important to note that there is a trade-off. These strategies may have to be diluted by the fund manager in order to ensure the necessary liquidity.

Potential for Improved Risk-Adjusted Returns

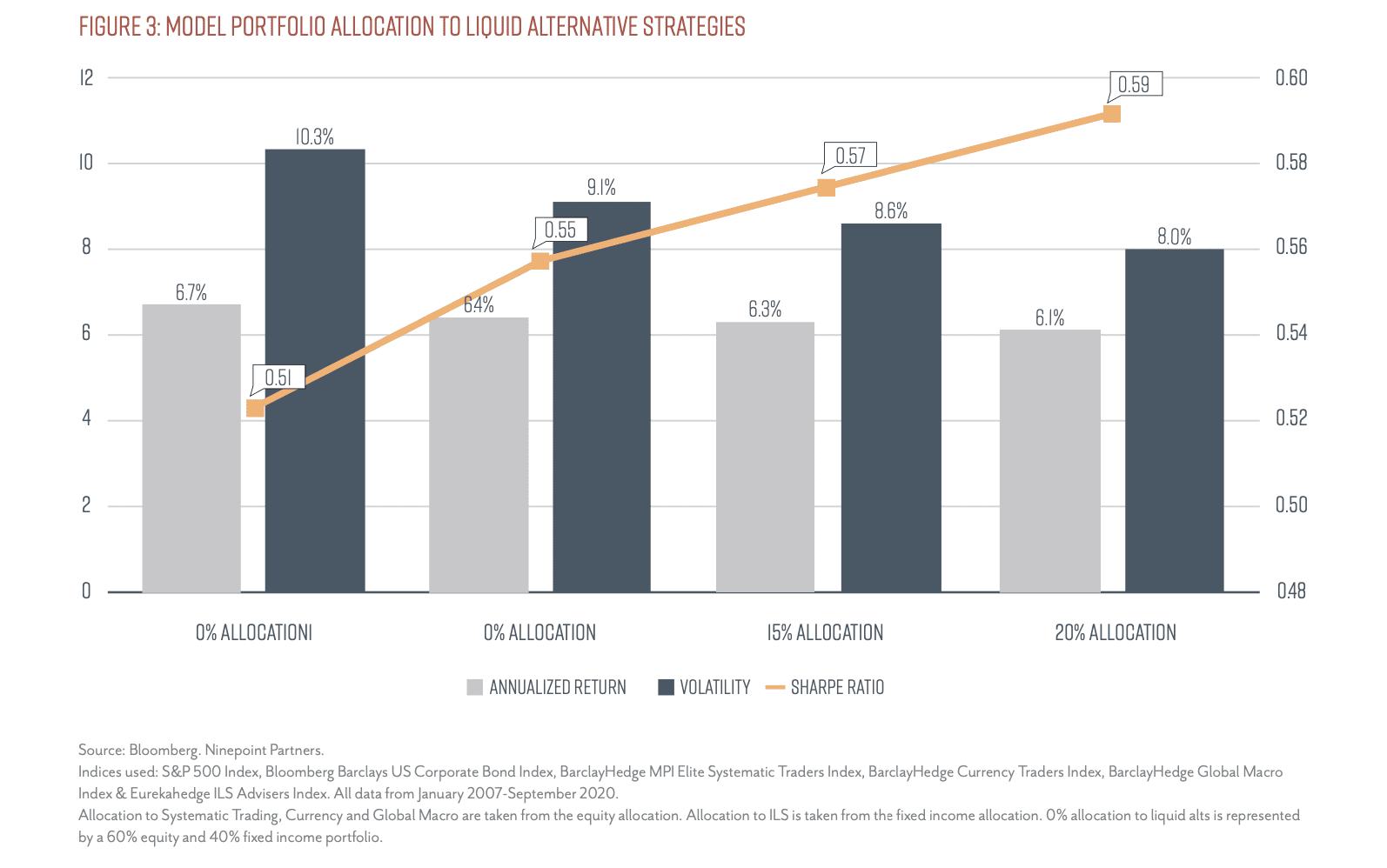

Using specific hedge indicies as proxies for the kinds of available Liquid Alt strategies discussed so far, Figure 3 shows the effect of adding different allocations of Liquid Alts to a starting 60% Equities/40% bonds portfolio. What can be observed is that, while returns are reduced modestly as allocations to Liquid Alts are increased, the portfolio’s volatility is reduced significantly, resulting in a better risk-return profile for the portfolio, as indicated by the improved Sharpe Ratio. This behaviour is what would be expected. The investment goal of a typical liquid alternative strategy is to generate absolute returns or achieve downside protection and, as such, to reduce a portfolio’s correlation to public equities and bonds. The effect for an investor is to produce a better diversified portfolio that generates stronger risk-adjusted returns.

This all said, it must be remembered that alternative investments tend to be more complex than traditional mutual funds, and Liquid Alternatives are no different in that respect. Hedge Funds typically outperform Liquid Alternatives that follow the same strategy, with more dispersion between top and bottom performers. This is due in part to the dilution of the hedge fund strategy when converted to a Liquid Alternative. The strategy is forced to operate more like a typical mutual fund, therefore most often reducing the diversification benefit of the strategy.

Like most actively managed funds, a strategy’s relative performance is a direct result of fund manager skill. With the recent popularity of Liquid Alternative funds, which are forecasted to grow to over $20 billion in assets in Canada by 2025, fund managers are looking to take advantage of this opportunity. Before making any decision to invest, investors need to consult with their financial advisors and do full due diligence on the strategy’s suitability for their investment goals and the fund manager’s track record of success in managing these kinds of strategies.

Click here to download the PDF.

Sightline Wealth Management LP (“Sightline”) is an investment dealer and is a member of the Investment Industry Regulatory Organization of Canada (IIROC) and the Canadian Investor Protection Fund (CIPF). Sightline provides management and investment advisory services to high-net-worth individuals and institutional investors primarily through fee-based accounts.

Sightline Wealth Management LP is a wholly owned subsidiary of Ninepoint Financial Group Inc. (“NFG Inc.”). NFG Inc. is also the parents company of Ninepoint Partners LP, it is an investment fund manager and advisor and exempt market dealer. By virtue of the same parent company, Sightline is affiliated with Ninepoint Partners LP. Information and/or materials contained herein is for information purposes only and does not constitute an offer to sell or solicitation to purchase securities of any issuer or any portfolio managed by Sightline Wealth Management or Ninepoint Partners, including Ninepoint managed funds.

Sightline Wealth Management (“Sightline”) makes every effort to ensure that the information has been derived from sources believed to be reliable and accurate. However, Sightline assumes no responsibility for any losses or damages, whether direct or indirect, which arise out of the use of this information. Sightline is not under any obligation to update or keep current the information contained herein. The information should not be regarded by recipients as a substitute for the exercise of their own judgment. Past performance is not indicative of future performance. Please speak to your Advisor regarding the suitability of information provided in this article for you. The opinions, estimates, projections and/or recommendations contained in this document are those of the author as of the date hereof.