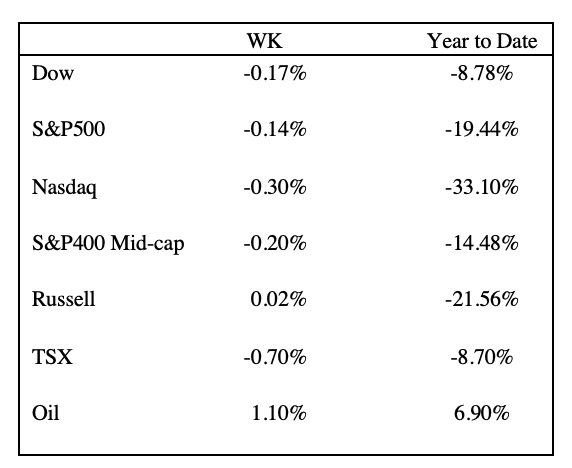

Last year will be one of those tumultuous years we would like to forget. Equities suffered one of the worst years since 2008. According to Morningstar, for the period ending November, bonds were on track to have the lowest return since 1926, adjusting for inflation.1 The only sector in positive territory was the energy sector, with the TSX energy sector up over 45% and the S&P energy sector up over 55%. The US dollar index fared well, rising 8% in the year. For the final week of the year, equity indices were modestly lower, except for the Russell 2000, which was flat on the week. Oil rose 1.10% in the week to finish the year up 6.10%. Bond yields traded higher on positive economic news.

In economic news last Tuesday, the S&P CoreLogic Case-Shiller Home Price Index for residential real estate covering all nine regions reported an annual gain of 9.2% in October, falling 1.5% from a month earlier. The 20-city composite lost 1.8% to 8.6%, and the 10-city composite fell 1.6% from the previous month to 8%. Miami, Tampa and Charlotte reported the largest year-over-year gains in the 20-city index, with increases of 21%, 20.5%, and 15%, respectively. Seattle and San Francisco reported the lowest year-over-year gains, falling over 10% since the peak in May.2 In a separate report from the FHFA tracking home values in all 50 states and over 400 American cities, home prices were flat for October, with housing prices rising 9.8% year-over-year.3 Housing is one of the lagging indicators the Fed is closely watching and comprises 32.7% of the Consumer Price Index.4

On Wednesday, the National Association of Realtors reported pending home sales decreased, falling 4% in November, for the sixth consecutive monthly decline. Based on contract signings year-over-year, the pending home sales index dropped by 37.8%. With falling mortgage rates in the month of December, there is optimism for a rebound in the coming months.5

On Thursday, the Department of Labor reported, for the period ending December 24, the seasonally adjusted initial unemployment claims at 225,000, an increase of 9,000 over the previous week. Continuing claims for all benefit programs ending December 10 was 1,619,728, an increase of 91,461 from the last week.6 Historically, economists don’t put much weight on the claims data around the holiday season. Another consideration in the lower-than-expected claims data is businesses that had difficulty in finding labor after the pandemic may be reluctant to lay off workers, artificially keeping initial claims data lower.

On Friday, the Chicago business barometer, which measures the performance of the manufacturing and non-manufacturing sector in the Chicago region, also known as the Chicago PMI, showed a significant rebound to 44.9 in December from 37.2 in November. While the latest reading is a serious increase over the previous month, it should be noted it is still in contraction territory. A reading less than 50 indicates economic contraction, whereas a reading over 50 indicates economic expansion.7 The manufacturing sector continues under pressure as global demand slows and the backlog of unfilled orders from the pandemic is filled and shipped.

Over the coming months, we believe the market sentiment will likely continue to be sensitive to the central bank language around policy decisions and the impact of political actions concerning the economy and foreign affairs.

Sources:

1 https://www.morningstar.ca/ca/news/229559/the-worst-bond-market-ever.aspx

3 https://www.fhfa.gov/AboutUs/Reports/ReportDocuments/FHFA-HPI-Monthly_12272022.pdf

5 https://www.nar.realtor/newsroom/pending-home-sales-slid-4-0-in-november

6 https://www.dol.gov/ui/data.pdf

7 https://tradingeconomics.com/united-states/chicago-pmi

Important Information:

Warren Gerow is an independent investment wealth consultant to Sightline Wealth Management.

Sightline Wealth Management LP (“Sightline”) is an investment dealer and is a member of the Investment Industry Regulatory Organization of Canada (IIROC) and the Canadian Investor Protection Fund (CIPF). Sightline provides management and investment advisory services to high-net-worth individuals and institutional investors.

Sightline Wealth Management LP is a wholly owned subsidiary of Ninepoint Financial Group Inc. (“NFG Inc.”). NFG Inc. is also the parent company of Ninepoint Partners LP, it is an investment fund manager and advisor and exempt market dealer. By virtue of the same parent company, Sightline is affiliated with Ninepoint Partners LP. Information and/or materials contained herein is for information purposes only and does not constitute an offer to sell or solicitation to purchase securities of any issuer or any portfolio managed by Sightline Wealth Management or Ninepoint Partners, including Ninepoint managed funds.

The opinions and information contained in this article are those of Sightline Wealth Management (“Sightline”) as of the date of this article and are subject to change without notice. Sightline endeavors to ensure that the content has been compiled from sources that we believe to be reliable. The information is not meant to be used as the primary basis of investment decisions and should not be constructed as advice. Each investor should obtain independent advice before making any investment decisions.