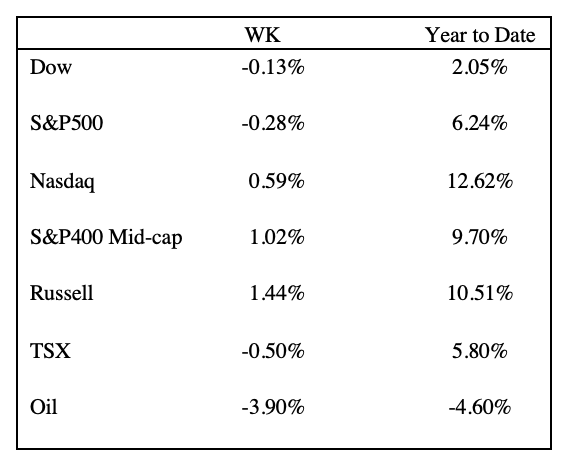

Equity markets ended the week mixed, with the Nasdaq and mid- and small-cap markets outpacing the Dow Jones and the S&P 500, which both drifted into negative territory by the week’s end. The TSX also ended the week slightly negative as oil fell 3.9%. Market sentiment was jolted last week by a reversal of CPI data, retail spending, and the tight labor market. We believe that the most recent economic data may lead the Fed, at its next meeting, to possibly consider a 50-basis point increase in rates rather than the expected 25 basis points. European equities rallied on better-than-expected earnings, ignoring fears of further rate hikes. The French CAC 40 hit an all-time high, as did the UK FTSE 100.

The Bureau of Labor Statistics reported the latest Consumer Price Index increasing 0.5%, after an increase of 0.1% in December. As a result, the all-items index rose 6.4% over the last 12 months. The core index, less food, and energy rose 0.4%, bringing the 12-month total to 5.6%. Shelter, which accounts for over one-third of the index, contributed to almost half of the items’ increase, with food and energy having a lesser impact. The only sectors with declines were fuel oil, used cars and truck prices, and medical care and services.1 The latest data prompted the Dallas Fed President Lorie Logan on Tuesday to say the central bank may need to push rates higher than expected. “We must remain prepared to continue rate increases for a longer period than previously anticipated if such a path is necessary to respond to changes in the economic outlook or to offset any undesired easing in conditions,” she said during a speech in Prairie View, Texas.2

On Wednesday, the Commerce Department reported that retail sales jumped 3% in January, topping all estimates. The increase was led by food service and drinking establishments (7.2%), auto and parts dealers (5.9%), and furniture stores (4.4%). Year-over-year retail sales have increased by 6.4%.3 Also, on Wednesday, the Federal Reserve of New York released the Empire State Manufacturing Survey. The headline general business conditions index climbed twenty-seven points but remained negative at -5.8. New orders declined slightly, shipments held steady, delivery times shortened, and inventories edged higher.4 The Industrial Production and Capacity Utilization for January remain unchanged from December, following a decline in December of 0.6% and a 1.0% decline in November. Manufacturing output increased by 1%, and mining input increased by 2% following two months of declines. Capacity Utilization in January declined by 0.1% to 78.3%, 1.3 % below the long-run average (1972-2022).5

As a reminder that the US labor market remains tight, unemployment claims for the week ending February 11 decreased by 1,000 from the previous week to 194,000, and continuing claims for all benefit programs for the week ending January 28 increased by 10,109 to 1,952,795.6

On Thursday, the Produce Price Index for January came in stronger than expected, with an increase of 0.7%. Excluding food and energy, the core PPI increased by 0.5%. The PPI index measures what raw goods cost on the open market. The PPI year to date is 6%, well off the high recorded in March 2022 at 11.6%.7 While the index is still increasing, the rate of increase is on the decline.

On Friday, the US Conference Board Leading Economic Index fell by 0.3% in January to 110.3. The LEI has been down 3.6% for the last six months compared to the previous six months of 2.4%. Of the LEI indicators, stock prices and labor markets are showing strength, whereas deteriorating manufacturing new orders, consumer expectations of business conditions, and credit conditions are dragging the index lower. The yield spread component turned negative in the last two months and is generally a signal of a recession. The Conference Board still expects slowing consumer spending, rising interest rates, and high inflation to edge the US economy into a recession sometime in 2023.8

There seems to be a disconnect between the data suggesting a recession and market sentiment, trading on the distant light at the end of the tunnel without an idea if the light is a candle or the sun.

Sources:

1 https://www.bls.gov/news.release/cpi.nr0.htm

2 https://www.dallasfed.org/news/speeches/logan/2023/lkl230214

3 https://www.census.gov/retail/marts/www/marts_current.pdf

4https://www.newyorkfed.org/medialibrary/media/survey/empire/empire2023/esms_2023_02.pdf?la=en

5 https://www.federalreserve.gov/releases/g17/current/default.htm

6 https://www.dol.gov/ui/data.pdf

7 https://www.bls.gov/news.release/ppi.nr0.htm

8 https://www.conference-board.org/topics/us-leading-indicators

Important Information:

Warren Gerow is an independent investment wealth consultant to Sightline Wealth Management.

Sightline Wealth Management LP (“Sightline”) is an investment dealer and is a member of the Investment Industry Regulatory Organization of Canada (IIROC) and the Canadian Investor Protection Fund (CIPF). Sightline provides management and investment advisory services to high-net-worth individuals and institutional investors.

Sightline Wealth Management LP is a wholly owned subsidiary of Ninepoint Financial Group Inc. (“NFG Inc.”). NFG Inc. is also the parent company of Ninepoint Partners LP, it is an investment fund manager and advisor and exempt market dealer. By virtue of the same parent company, Sightline is affiliated with Ninepoint Partners LP. Information and/or materials contained herein is for information purposes only and does not constitute an offer to sell or solicitation to purchase securities of any issuer or any portfolio managed by Sightline Wealth Management or Ninepoint Partners, including Ninepoint managed funds.

The opinions and information contained in this article are those of Sightline Wealth Management (“Sightline”) as of the date of this article and are subject to change without notice. Sightline endeavors to ensure that the content has been compiled from sources that we believe to be reliable. The information is not meant to be used as the primary basis of investment decisions and should not be constructed as advice. Each investor should obtain independent advice before making any investment decisions.