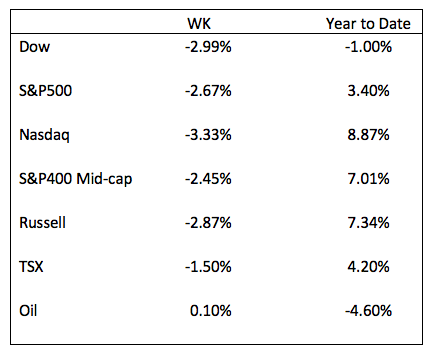

Equity markets struggled, succumbing to inflation data and earnings guidance, finishing with weekly losses. However, except for the Dow Jones, which by week’s end fell into negative territory year to date, equity indices remained positive for the year. Value held slightly better than growth stocks in the broad-based decline. In Europe, equities fell on better-than-expected corporate earnings and positive economic data, leading investors to anticipate further rate hikes in the coming months.

As reported by FactSet, for Q4 2022 (with 94% of S&P 500 companies reporting actual results), 68% of S&P 500 companies have reported a positive EPS surprise and 66% of S&P 500 companies have reported a positive revenue surprise. For Q4, the blended earnings decline is -4.8%, which, if held as the final number, is the first negative quarter since Q3 of 2020 (-5.7). The EPS guidance for Q1 2023 has only 21 of the S&P 500 companies issuing positive guidance and 76 of the companies giving negative EPS guidance. The forward 12-month P/E ratio for the S&P 500 is 17.7. This P/E ratio is below the 5-year average (18.5) but above the 10-year average (17.2). The financials and communication services were the two sectors with the largest contributions to the decrease in earnings for the index since December 31.1

On Tuesday, February’s S&P Global Flash US Composite PMI rose to 50.2 from January’s reading of 46.8. The latest level is the highest in eight months, partly driven by the services sector and a slowing of the decline in the manufacturing sector. The Manufacturing Output Index for February rose to 48.4 from January’s 46.9, and the Manufacturing PMI increased to 47.8 from 46.9. New orders across the private sector declined, as did the new export orders. The input price of inflation was the second slowest since October 2020, with materials and components prices weaker, but services and wages increased, keeping inflation elevated. Employment remained strong in the quarter.2

On Wednesday, the US Federal Reserve released the minutes from the February 1 meeting. The minutes reinforced the committee’s commitment to hold policy rates “sufficiently restrictive to return inflation to 2 percent over time.” It also revealed that more than two committee members suggested a 50-basis point rate hike rather than the 25 basis points at the last meeting as financial conditions have eased. The Fed staff forecast still expects GDP growth “to slow markedly this year and the labor market to soften.”3

In a continuing signal of a strong labor market, on Thursday, the US Labor Department reported that the adjusted initial claims for the week ending February 18 decreased by 3,000 from the previous week to 192,000. The benefits for all claim programs increased by 25,690 to 1,979,303 for the week ending February 4.4

The US government released the closely watched PCE (personal consumption index) on Friday. The headline rate jumped 0.6%, bringing the annual rate to 5.4% from 5.3% in December. This is the first increase in seven months. The core rate, excluding energy and food, is more closely watched by the US Fed and increased by 0.6%, bringing the 12-month inflation rate to 4.7% from 4.6%. In another surprise, consumer spending jumped 1.8% in January, driven partly by increased auto sales, which is unlikely to last long, and incomes rose by 0.6%.5 The Commerce Department reported on Friday that new single-family home sales jumped to an annual rate of 670,00 from the December rate of 625,000. The latest figure is 7.2% over the December rate but 19.4% below December 2022. Existing home sales continue to slow, while new home sales have increased for four consecutive months.6

The University of Michigan released the final reading for the Index of Consumer Sentiment at 67, the Current Economic Conditions Survey at 70.7, and the Index of Consumer Expectations at 64.7. All three surveys improved significantly over the previous readings in January.7

Equity markets will continue to wrestle with the data, the reality of slow growth, and the possibility of a recession in the coming months. In the current environment, we believe it is possible to test the previous lows of October before we have a sustainable move higher. As it was considered trash in the past, cash could be the only short-term safe haven.

Sources:

2 https://www.pmi.spglobal.com/Public/Home/PressRelease/1a48b2fdf6114741aade2fd71f25f4a6

3 https://www.federalreserve.gov/monetarypolicy/files/monetary20230201a1.pdf

4 https://www.dol.gov/ui/data.pdf

5 https://www.bea.gov/news/2023/personal-income-and-outlays-january-2023

6 https://www.census.gov/construction/nrs/current/index.html

7 http://www.sca.isr.umich.edu/

Important Information:

Warren Gerow is an independent investment wealth consultant to Sightline Wealth Management.

Sightline Wealth Management LP (“Sightline”) is an investment dealer and is a member of the Investment Industry Regulatory Organization of Canada (IIROC) and the Canadian Investor Protection Fund (CIPF). Sightline provides management and investment advisory services to high-net-worth individuals and institutional investors.

Sightline Wealth Management LP is a wholly owned subsidiary of Ninepoint Financial Group Inc. (“NFG Inc.”). NFG Inc. is also the parent company of Ninepoint Partners LP, it is an investment fund manager and advisor and exempt market dealer. By virtue of the same parent company, Sightline is affiliated with Ninepoint Partners LP. Information and/or materials contained herein is for information purposes only and does not constitute an offer to sell or solicitation to purchase securities of any issuer or any portfolio managed by Sightline Wealth Management or Ninepoint Partners, including Ninepoint managed funds.

The opinions and information contained in this article are those of Sightline Wealth Management (“Sightline”) as of the date of this article and are subject to change without notice. Sightline endeavors to ensure that the content has been compiled from sources that we believe to be reliable. The information is not meant to be used as the primary basis of investment decisions and should not be constructed as advice. Each investor should obtain independent advice before making any investment decisions.