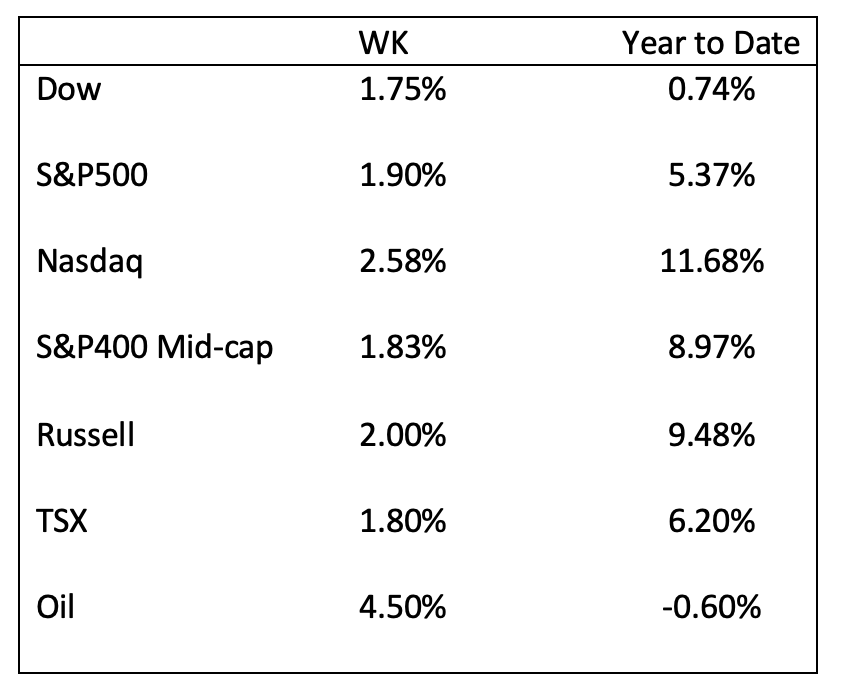

Equity reversed course after weeks of declines and posted strong gains, with energy and materials leading, and Meta Platforms in the communications sector adding support. The price of oil jumped in the week by 4.5%, providing a welcome boost to Canadian indices. The S&P 500 held above the 200-day moving average, often considered a critical resistance level. European equities followed suit, ignoring worries about rising interest rates; instead, investors found promising signs of improving economies.

In a sign of the manufacturing sector coming under stress, Durable Goods for January fell 4.5% following a December decrease of 5.1%. New orders increased by 0.7% after stripping out transportation; excluding defense, new orders decreased by 5.1%. Shipments declined by 0.1% in January after sixteen consecutive months of increases. Following 23 consecutive increases, inventories of manufactured durable goods moved slightly lower by 0.1%. In the capital goods area, nondefense new orders in January collapsed by 15.3%. Shipments decreased by 1.0%, unfilled orders fell by 0.1%, and inventories decreased by 0.2%. Defense capital goods orders rose by 3.8% in January.1

While slightly higher than January, the ISM February manufacturing PMI for February is still in contraction territory at 47.7, 0.3% higher than the previous month and the third consecutive month in contraction after 30 months of expansion. The New Orders index increased by 4.5 percentage points over January but remained in contraction territory at 47.3, while the Prices Index jumped 6.8 percentage points to 51.3%. The Backlog of Orders Index improved to 45.1, and the Employment Index dropped to 49.1%. (A reading below 50 indicates an economy contracting, and a reading over 50 indicates economic expansion.) Respondents to the survey were mixed, with some indicating slowing (plastics and rubber products, food and beverage) and others holding steady (electrical equipment, appliances, components, computer and electronic products).2 The Services PMI for February remains in expansion territory with a reading of 55.1%, 0.1 percentage points lower than January. The Business Activity Index fell 4.1 percentage points to 56.3, and the New Orders Index increased 2.2% to 62.6 in February.3

The big surprise in the week came from the National Association of Realtors, reporting pending homes sales had jumped 8.1%, responding to falling mortgage rates in December and January. All four regions in the survey reported monthly gains, but the number of transactions has declined year-over-year. The rising mortgage rates could slow pending home sales in the coming months ahead.4 As S&P CoreLogic Case-Shiller Index reported, home prices show slowing price increases in all areas of the nation. The latest data reported an increase of 5.8% for all nine regions in December compared to 7.6% in the previous month. Miami led with a 15.9% increase, followed by Tampa with a rise of 13.9%, and Atlanta with a 10.4% increase.5

The Conference Board last week reported the Consumer Confidence Index fell to 102.9, down from 106.0 in January. The Present Situation Index, a reading of consumers’ views on current labor and business conditions, increased to 152.8 from 151.1 last month. The Expectation Index, consumers’ short-term outlook for income, business, and labor market conditions, dropped to 69.7 from 76.0 in January. A reading below 80 often signals a recession within the next 12 months. The drop in consumer confidence largely can be attributed to the cohort aged 35 to 54 and households earning less than $35,000.6

US initial jobless claims for unemployment benefits was 190,000 for the week ending February 25. The recent number is 2,000 less than the previous week’s adjusted number and below the 200,000 pre-Covid number. Benefits for all programs for the week ending February 11 was 1,959,037, a decrease of 20,276.7

The US Labor Department reported productivity growth of 1.7%, lower than the expected preliminary number of 3.0%, for the fourth quarter of 2022. Output increased by 3.1%, and hours worked increased by 1.4%. Non-farm business unit labor costs were up 3.2%, reflecting a 4.9% increase in hourly compensation and a 1.7% increase in productivity.8

Market sentiment could bounce between data points as investors continue to view the world through rose-tinted glasses while the Fed tries its best to navigate the rough seas of what could be a coming storm. The uncertainty of what lies ahead could provide continued volatility in the months ahead for both bonds and equities.

Sources:

1 https://www.census.gov/manufacturing/m3/adv/pdf/durgd.pdf

5 https://press.spglobal.com/2023-02-28-S-P-CORELOGIC-CASE-SHILLER-INDEX-DECLINE-CONTINUED-IN-DECEMBER

6 https://www.conference-board.org/topics/consumer-confidence

7 https://www.dol.gov/ui/data.pdf

8 https://www.bls.gov/news.release/archives/prod2_03022023.htm

Important Information:

Warren Gerow is an independent investment wealth consultant to Sightline Wealth Management.

Sightline Wealth Management LP (“Sightline”) is an investment dealer and is a member of the Investment Industry Regulatory Organization of Canada (IIROC) and the Canadian Investor Protection Fund (CIPF). Sightline provides management and investment advisory services to high-net-worth individuals and institutional investors.

Sightline Wealth Management LP is a wholly owned subsidiary of Ninepoint Financial Group Inc. (“NFG Inc.”). NFG Inc. is also the parent company of Ninepoint Partners LP, it is an investment fund manager and advisor and exempt market dealer. By virtue of the same parent company, Sightline is affiliated with Ninepoint Partners LP. Information and/or materials contained herein is for information purposes only and does not constitute an offer to sell or solicitation to purchase securities of any issuer or any portfolio managed by Sightline Wealth Management or Ninepoint Partners, including Ninepoint managed funds.

The opinions and information contained in this article are those of Sightline Wealth Management (“Sightline”) as of the date of this article and are subject to change without notice. Sightline endeavors to ensure that the content has been compiled from sources that we believe to be reliable. The information is not meant to be used as the primary basis of investment decisions and should not be constructed as advice. Each investor should obtain independent advice before making any investment decisions.