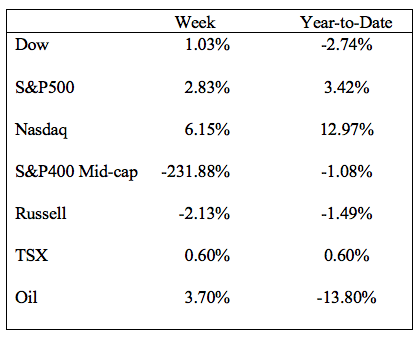

Equity markets experienced another tumultuous week driven by the banking sector and recession worries. Large-cap tech stocks benefited from falling interest rates, while value and small-cap stocks struggled. For the third week, financials, particularly the banking sector, came under pressure due to liquidity concerns and fears that depositors would shift deposits from the regional banks to much larger and more regulated banks. The major European indices were up during the week despite weakness in the banking sector attributed to Credit Suisse and, later in the week, Deutsche Bank.

The economic calendar for the week was light. The National Association of Realtors announced Tuesday that existing home sales jumped 14.5% in February, as mortgage rates softened. This was the most significant monthly increase since July 2020 when sales surged 22.4%. The median home sale price decreased by 0.2% from a year ago to $363,000. At the current monthly sales pace, inventory levels remained flat from the previous month at 2.6 months.1 On Thursday, the Department of Labor reported that initial unemployment claims decreased by 1,000 from the previous week to 191,000. Claims for benefits in all programs for the week ending March 4 decreased by 61,496 to 1,857,801. Jobless benefits claims remain stubbornly low and indicate the economy’s resilience.2

On Friday, the Census Bureau reported that durable goods orders dropped 1% surprisingly, when analysts expected a modest rebound of 0.2%. The revision of the January 4.5% drop to 5.0% in the month worsened the overall statistic. Core orders, excluding transportation, remained flat. On the encouraging front, core capital goods, such as aircraft and military, rose 0.2% in February. Shipments decreased by 0.6% for the second month following the 0.4% decrease in January. Unfilled orders fell 0.2%, and inventories of manufactured durable goods in February rose 0.2%.3

Rounding out the week, the S&P Global Flash US PMI Composite Index jumped to 53.1 in March compared to 50.1 in February. The Flash Services PMI Activity Index rose to 53.8 from 50.6 a month earlier. The Flash Manufacturing Output Index increased to 51.2 versus February’s 47.4. A reading over 50 indicates economic expansion, and under 50 designates contraction. The Flash Manufacturing Index is still struggling with higher input prices, coming in at 49.3 compared to February’s 47.3.4

On Wednesday, the United States Federal Reserve raised rates by 0.25%. In the press conference following the decision announcement, Jerome Powell, chairman of the Federal Reserve, signaled a more dovish tone from previous meetings when he said, “Since our previous Federal Open Market Committee (FOMC) meeting, economic indicators have generally come in stronger than expected, demonstrating greater momentum in economic activity and inflation. We believe, however, that events in the banking system over the past two weeks are likely to result in tighter credit conditions for households and businesses, which would, in turn, affect economic outcomes. It is too soon to determine the extent of these effects, and therefore too soon to tell how monetary policy should respond. As a result, we no longer state that we anticipate that ongoing rate increases will be appropriate to quell inflation; instead, we now anticipate that some additional policy firming may be appropriate. We will closely monitor incoming data and carefully assess the actual and expected effects of tighter credit conditions on economic activity, the labor market and inflation, and our policy decisions will reflect that assessment.”5

We believe the market will interpret his comments to suggest there is likely to be one more rate increase this year before a pause. While Chairman Powell stated he did not see rates coming down in 2023, the market will anticipate a pause or a possible rate decrease, especially if the regional banking crisis escalates. If a rate decrease does occur, the equity markets could move higher for the remainder of the year.

Sources:

2 https://www.dol.gov/ui/data.pdf

3 https://www.census.gov/manufacturing/m3/adv/pdf/durgd.pdf

4https://www.pmi.spglobal.com/Public/Home/PressRelease/53e9f887b83e47d7bc6681c608d5aa3f

5 https://www.federalreserve.gov/mediacenter/files/FOMCpresconf20230322.pdf

Important Information:

Warren Gerow is an independent investment wealth consultant to Sightline Wealth Management.

Sightline Wealth Management LP (“Sightline”) is an investment dealer and is a member of the Investment Industry Regulatory Organization of Canada (IIROC) and the Canadian Investor Protection Fund (CIPF). Sightline provides management and investment advisory services to high-net-worth individuals and institutional investors.

Sightline Wealth Management LP is a wholly owned subsidiary of Ninepoint Financial Group Inc. (“NFG Inc.”). NFG Inc. is also the parent company of Ninepoint Partners LP, it is an investment fund manager and advisor and exempt market dealer. By virtue of the same parent company, Sightline is affiliated with Ninepoint Partners LP. Information and/or materials contained herein is for information purposes only and does not constitute an offer to sell or solicitation to purchase securities of any issuer or any portfolio managed by Sightline Wealth Management or Ninepoint Partners, including Ninepoint managed funds.

The opinions and information contained in this article are those of Sightline Wealth Management (“Sightline”) as of the date of this article and are subject to change without notice. Sightline endeavors to ensure that the content has been compiled from sources that we believe to be reliable. The information is not meant to be used as the primary basis of investment decisions and should not be constructed as advice. Each investor should obtain independent advice before making any investment decisions.