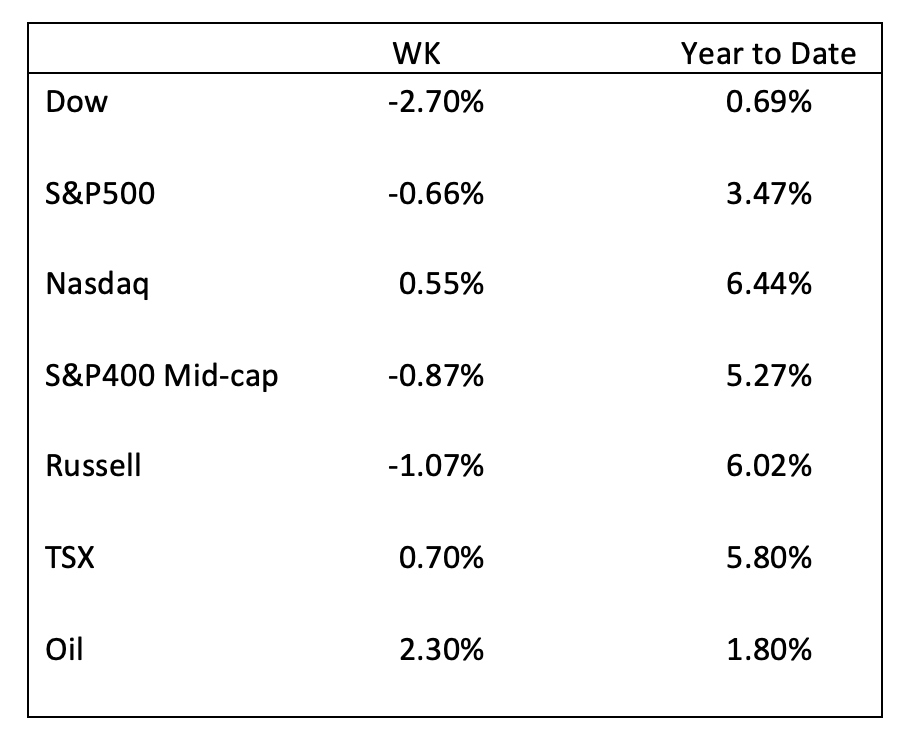

Expectations of slowing inflation and the prospect of lower interest rates in Canada and the US helped investors rotate to growth stocks during the week. The Nasdaq was the only index in the US to record a gain in the week, while the Dow Jones fell over 2%. The TSX, propelled by oil jumping 2.3%, also remained in positive territory. European equity indices finished modestly lower on the hawkish tone from European Central Bank policymakers. Bonds remain the bright spot as the Bloomberg Canada Aggregate Bond index gained 0.9% and the Bloomberg US Aggregate Bond index increased 0.5%. Both bond indices are up 3.45% and 3.80% year-to-date, respectively. Lower bond rates, we believe, reflect lower inflationary expectations and slow economic growth.

The week’s data supports the belief that the economy is slowing. On Tuesday, the New York Fed’s Empire State Manufacturing Survey for January revealed that the general business conditions index fell 22 points to -32.9. The latest reading is the lowest reading since the low in the pandemic and the fifth worst reading in the survey’s history. The new orders index fell 28 points to -31.1, and the shipments index fell 28 points to -22.4 points. Delivery times held, inventories improved slightly, employment growth slowed, and the average workweek was reduced, while the pace of the cost and selling price increases slowed in the month.1

The big economic data point of the week was retail sales falling 1.1% in December, but still up 6% over December 2021. Falling gas prices and auto sales contributed to the second monthly drop, however, it does not explain the whole story. Excluding gas sales and autos, receipts fell 0.7%, indicating a general slowing trend but also a shift in spending to services such as recreation and travel.2

From an inflationary point of view, on Wednesday, the Bureau of Labor and Statistics reported US Producer Price index for final demand fell 0.5% in December. The December decrease was attributed to a 1.6% increase decline in prices for final demand compared to an increase of 0.1% in final demand for services.3 As reported by the Federal Reserve, industrial production fell in December by 0.7% and for the quarter fell 1.7% annualized. Business equipment experienced the largest drop (2.0%), followed by construction supplies (1.4%) and business supplies (1.3%). Manufacturing output fell 1.3% in December and 2.5% annualized in the quarter. Within the durables sector, the largest declines were in machinery and wood products, falling 3.4% and 2.1%, respectively. In the nondurable category, all major industries fell, led by printing and support as well as petroleum and coal products, which descended by more than 3%. Manufacturing productivity fell 1% in December to 77.5%, lower than the long-run average of 78.3%.4

The employment picture is of the critical indicators the Fed monitors in the fight against inflation. On Thursday, the initial unemployment claims for the period ending January 14 were 190,000, a decrease from the previous week of 15,000. Continuing claims for all benefit programs ending December 31 increased by 159,159 to 1,893,525.5 The Fed anticipates that unemployment should increase as rate increases take hold, reflecting a slowing economy. To date, the employment data continues to be more robust than policymakers would like to see, and we believe in providing cover for additional rate increases in the coming weeks.

The final data point of interest in the week, and another sign of a weakening economy, was existing homes sales, which fell for the 11th straight month to a seasonally adjusted rate of 4.02 million, down 1.5% from November and 34% from one year ago.6 Housing starts also fell 1.4%, and building permits fell 1.6% in December, as reported by the Commerce Department.7

We believe the market is trading in anticipation of a soft landing, the slowing of rate increases, and the potential pausing of the Fed’s restrictive monetary policy after a second-rate increase during the second Fed meeting of the year. Unfortunately, the rhetoric of Fed policymakers is not entirely on the same page as investors, typically causing volatility whenever one of the Board members gives a speech reflecting Fed thinking. We think this will continue to lead to volatility until both parties are on the same page.

Sources:

1https://www.newyorkfed.org/medialibrary/media/survey/empire/empire2023/esms_2023_01.pdf?la=en

2https://www.census.gov/retail/marts/www/marts_current.pdf

3https://www.bls.gov/news.release/ppi.nr0.htm

4https://www.federalreserve.gov/releases/g17/current/default.htm

5https://www.dol.gov/ui/data.pdf

6https://www.nar.realtor/newsroom/existing-home-sales-receded-1-5-in-december

7https://www.census.gov/construction/nrc/pdf/newresconst.pdf

Important Information:

Warren Gerow is an independent investment wealth consultant to Sightline Wealth Management.

Sightline Wealth Management LP (“Sightline”) is an investment dealer and is a member of the Investment Industry Regulatory Organization of Canada (IIROC) and the Canadian Investor Protection Fund (CIPF). Sightline provides management and investment advisory services to high-net-worth individuals and institutional investors.

Sightline Wealth Management LP is a wholly owned subsidiary of Ninepoint Financial Group Inc. (“NFG Inc.”). NFG Inc. is also the parent company of Ninepoint Partners LP, it is an investment fund manager and advisor and exempt market dealer. By virtue of the same parent company, Sightline is affiliated with Ninepoint Partners LP. Information and/or materials contained herein is for information purposes only and does not constitute an offer to sell or solicitation to purchase securities of any issuer or any portfolio managed by Sightline Wealth Management or Ninepoint Partners, including Ninepoint managed funds.

The opinions and information contained in this article are those of Sightline Wealth Management (“Sightline”) as of the date of this article and are subject to change without notice. Sightline endeavors to ensure that the content has been compiled from sources that we believe to be reliable. The information is not meant to be used as the primary basis of investment decisions and should not be constructed as advice. Each investor should obtain independent advice before making any investment decisions.