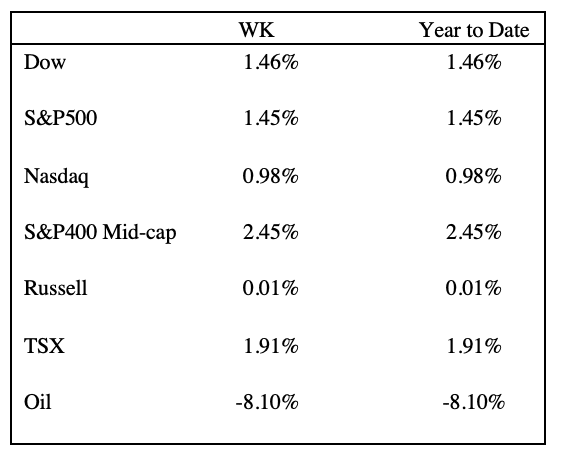

Early in the week, equity indices came under pressure from data showing robust job openings and decreasing initial unemployment claims. By Friday, the Labor Department’s nonfarm payrolls report showing the smallest increase in two years and softening wage growth spurred the market to finish the week in positive territory. All North American equity indices finished the week higher, with communication services stocks leading the gains. The major stock indexes in Europe surged higher on data indicating that inflation had slowed as natural gas prices fell to levels last seen before Russia invaded Ukraine. The oil price finished the week at $73.76, falling just over 8%.

On Tuesday, in another sign of weakening economic activity, the S&P Global U.S. Manufacturing PMI reading for December decreased to 46.2 from the November reading of 47.7. December’s latest reading was the lowest and steepest contraction since the initial COVID-19 lockdown in May 2020. The reduced purchasing power among customers resulted in new orders falling at one of the fastest paces recorded. Foreign orders also fell on U.S. dollar strength and global economic uncertainty.1 On Wednesday, the U.S. Labour Department reported job openings in the U.S. fell slightly to 10.46 million in November. During the month, job openings increased in professional services and nondurable goods manufacturing. Sectors with job opening decreases were finance and insurance and the federal government. The quits rate remains relatively elevated, indicating the labor market remains quite strong. The current job openings data represents 1.7 job openings for each unemployed worker, substantially higher than the 1.2 job openings per unemployed worker pre-pandemic.2

On Thursday, ADP reported that private-sector employment rose by 127,000 jobs in November. Job creation slowed by the most since January 2021, with the most significant changes occurring in manufacturing, losing 100,000 jobs in the goods-producing sector and leisure and hospitality, and gaining 224,000 jobs in the service-providing industry. By region, the northeast gained 158,000 jobs, the Midwest lost 41,000, the South lost 2,000, and the West gained 12,000. Medium-sized companies gained 246,000 jobs, whereas small and large-cap companies gave up 51,000 jobs and 68,000 jobs, respectively.3 Initial unemployment claims for the week ending December 31 were 204,000, a decrease of 19,000 from the previous week. The number of continuing claims from all benefit programs for the week ending December 17 shows a decrease of 18,444 from the last period to 1,601,289.4 We believe the latest unemployment claims data provides little verification that the labor market is cooling as the economy slows, allowing the Fed to continue with a restrictive interest rate policy.

On Friday, the U.S. Bureau of Labor Statistics reported nonfarm payroll employment increased by 223,000 in December, the smallest increase in two years. The unemployment rate fell to 3.5% from 3.6%, and wage growth slowed to 0.3% after a blistering rise in the previous months.5 Also, on Friday, the Institute for Supply Management, in its survey of U.S. business conditions at service-oriented companies, reported a decrease to 49.6% in December, entering negative territory for the first time since early in the pandemic. In a similar survey for the manufacturing sector, the survey registered 48.4%, 0.6% lower than the November reading. While the manufacturing sector has been under pressure, the latest IMS reading for services suggests business conditions in the service sector are weakening. A reading below 50 indicates a contraction, whereas a number over 50 indicates an expansion.6

In a speech on Friday, Atlanta Fed president Ralph Bostic continued Federal Reserve Chairman Powell’s mantra of “quote more work to do.” Further, he indicated the Federal Reserve should raise the high end of the policy interest rate range to 5.25%, although he was open about the pace of further rate hikes.7

Unfortunately, the Fed remains hawkish despite current data showing signs of weakness in the economy, except for labor. Last week, the ISM for the services sector, representing 70% of the economy, finally showed signs of slowing. Through the lens of the market, investors continue to believe the end is near for further rate increases; at the same time, the Fed rhetoric is to the contrary. We think the debates over Fed policy will continue in the coming weeks producing significant intra-week volatility.

Sources:

1 https://tradingeconomics.com/united-states/manufacturing-pmi

2 https://www.bls.gov/news.release/pdf/jolts.pdf

4 https://www.dol.gov/ui/data.pdf

5 https://www.bls.gov/news.release/empsit.nr0.htm

6 https://www.ismworld.org/supply-management-news-and-reports/news-publications/

Important Information:

Warren Gerow is an independent investment wealth consultant to Sightline Wealth Management.

Sightline Wealth Management LP (“Sightline”) is an investment dealer and is a member of the Investment Industry Regulatory Organization of Canada (IIROC) and the Canadian Investor Protection Fund (CIPF). Sightline provides management and investment advisory services to high-net-worth individuals and institutional investors.

Sightline Wealth Management LP is a wholly owned subsidiary of Ninepoint Financial Group Inc. (“NFG Inc.”). NFG Inc. is also the parent company of Ninepoint Partners LP, it is an investment fund manager and advisor and exempt market dealer. By virtue of the same parent company, Sightline is affiliated with Ninepoint Partners LP. Information and/or materials contained herein is for information purposes only and does not constitute an offer to sell or solicitation to purchase securities of any issuer or any portfolio managed by Sightline Wealth Management or Ninepoint Partners, including Ninepoint managed funds.

The opinions and information contained in this article are those of Sightline Wealth Management (“Sightline”) as of the date of this article and are subject to change without notice. Sightline endeavors to ensure that the content has been compiled from sources that we believe to be reliable. The information is not meant to be used as the primary basis of investment decisions and should not be constructed as advice. Each investor should obtain independent advice before making any investment decisions.